Payment services act as the middleman between your business, your customer's payment method, and your bank. When a customer makes a purchase, the transaction information is securely transmitted, processed, and funds are deposited into your business account.

Most payment services providers allow you to accept a variety of payments including major credit and debit cards, contactless payments, mobile wallets (like Apple Pay and Google Pay), online payments, and sometimes even ACH bank transfers.

That depends on your business type. Retail businesses typically need a point-of-sale (POS) terminal or card reader, while online businesses require a secure payment gateway. Many providers offer mobile payment options and virtual terminals as well.

Funding times can vary by provider, but most businesses receive their funds within 1 to 3 business days. Some services offer same-day or next-day deposits for an additional fee.

Transaction fees typically depend on factors such as the type of card used, the transaction method (in-person, online, or keyed-in), and your agreement with the merchant services provider. Fees usually include a percentage of the transaction amount plus a flat fee per transaction.

Many payment services providers offer omnichannel solutions, allowing you to accept payments both online and in-person using a single account and unified reporting system.

Contract terms vary by provider. Some offer month-to-month service with no cancellation fees, while others may require a longer commitment. It's always a good idea to review the contract details carefully before signing.

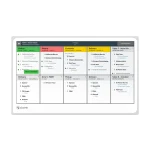

Compact

Compact Flex

Flex Flex Pocket

Flex Pocket Go

Go Kiosk

Kiosk Kitchen Display System

Kitchen Display System Mini

Mini Station Duo

Station Duo Station Solo

Station Solo